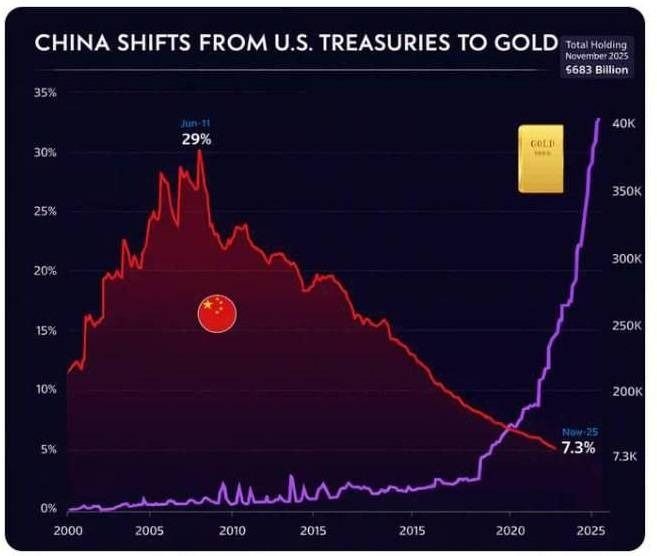

China cuts US Treasury holdings to lowest level since 2008

China has reduced its holdings of U.S. Treasury bonds to $683 billion, the lowest level since 2008, down from $769 billion a year earlier, reflecting a continued recalibration of its reserve strategy, AzerNEWS reports.

At the same time, China’s gold reserves have expanded for 15 consecutive months, reaching a new record value of $370 billion, underscoring Beijing’s accelerated move toward diversification.

The reduction comes amid reports that China has advised domestic banks to limit investments in U.S. Treasury securities as part of broader efforts to spread risk and reduce exposure to dollar-denominated assets. These steps coincide with growing global debate over the long-term reliability of the dollar and the United States as the world’s primary safe haven for capital.

Despite the decline, China remains the third-largest foreign holder of U.S. government debt. Japan continues to top the list with around $1.2 trillion in U.S. Treasury holdings. Overall, foreign investors account for roughly 30 percent of total U.S. government debt.

Here we are to serve you with news right now. It does not cost much, but worth your attention.

Choose to support open, independent, quality journalism and subscribe on a monthly basis.

By subscribing to our online newspaper, you can have full digital access to all news, analysis, and much more.

You can also follow AzerNEWS on Twitter @AzerNewsAz or Facebook @AzerNewsNewspaper

Thank you!