Can new state program reverse Azerbaijan’s tourism slowdown?

On paper, Azerbaijan should be a tourism success story. She wants more tourists, and quickly. A new state program aims to lift annual arrivals to between five and six million within a few years, roughly double today’s level. As Baku prepares a new tourism program with ambitious numerical targets, the gap between aspiration and performance has become harder to ignore. Ambitions are optimistic and perhaps plausible, but what were the problems before, and what should be done to see a rise in stagnant numbers?

The government has unveiled the first-ever State Program for the Development of Tourism, designed to significantly increase inbound travel and reposition the country as a diversified tourism destination in the medium term. The goal is clear and numeric: increase inbound tourist arrivals to 5–6 million people in the medium term. Yet current statistics, structural weaknesses, and regional comparisons suggest that achieving this target will require more than strategic intent.

Between January and November 2025, Azerbaijan received 2.364 million tourists from 189 countries, marking a 2% decline compared to the same period in 2024. While the figure demonstrates geographic diversification, it also confirms stagnation rather than sustained growth.

The distribution of arrivals highlights Azerbaijan’s continued dependence on a limited number of markets:

-

Russia – 24.2%

-

Türkiye – 17.6%

-

Iran – 8.1%

-

India – 6.4%

-

Georgia – 4.3%

Together, these five countries account for more than 60% of total arrivals. Meanwhile, 76% of tourists entered Azerbaijan by air, 22.7% by rail and road, and only 1.3% by sea, underscoring how aviation constraints directly affect tourism growth.

There were positive dynamics in specific markets. Arrivals from Israel increased 2.3 times, from China by 43.1%, Uzbekistan by 38.6%, and Japan by 26.4%. However, these gains were offset by a 7.8% decline from CIS countries and a 2.8% decrease from Gulf states, traditionally high-spending markets.

When benchmarked against regional peers, Azerbaijan’s tourism performance remains modest. In 2023, tourism revenues reached approximately $1.49 billion, compared to $4.12 billion in Georgia and over $3.1 billion in Armenia, despite Azerbaijan’s larger economy and infrastructure base.

Even in 2024, Azerbaijan remained the lowest tourism revenue generator in the South Caucasus, with around $1.56 billion, while Georgia exceeded $3.4 billion. This gap highlights a structural issue: tourist numbers alone are not translating into value, length of stay, or high per-capita spending.

What the state program promises?

The upcoming State Program seeks to address these gaps through measurable policy shifts. Key priorities include:

-

Airspace liberalization to reduce ticket prices and expand international routes

-

Expansion of visa-free regimes, especially for long-haul and high-growth markets

-

Improved regional accessibility, targeting destinations beyond Baku

-

Tourism diversification, positioning Azerbaijan as a destination for gastronomy, health, winter, and ecotourism

The program also includes plans to increase investment in Tourism and Recreation Zones, create new beaches, support micro and small tourism businesses, and strengthen safety and quality standards across the sector. Institutionally, it envisages the creation of a Tourism Information System, expanded research funding, and new educational programs to address workforce shortages.

Why tourist flow not scaled, due to structural constraints?

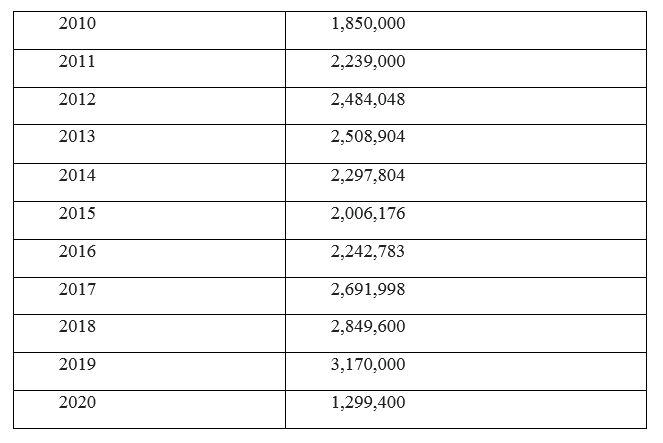

Despite multiple strategies and campaigns over the past decade, Azerbaijan’s tourist numbers have never exceeded the 3.17 million peak recorded in 2019. Even during the growth years between 2010 and 2019, increases were incremental rather than transformative.

Several persistent issues explain this pattern:

Over-centralization in Baku, which absorbs the majority of infrastructure, hotel capacity, and marketing visibility

Weak digital presence, including limited SEO optimization, low integration with global booking platforms, and insufficient mobile-friendly content

Infrastructure gaps in regions, such as poor road signage, a lack of service areas, and limited multilingual guidance

Price–quality imbalance, with tourists frequently reporting high prices for mid-level services

Low brand recognition, with surveys showing that over 50% of foreign tourists rate Azerbaijan as only “slightly recognisable” as a tourism brand

Language accessibility remains another barrier. Nearly half of foreign visitors cite limited multilingual services as a key frustration, directly affecting satisfaction and repeat visits.

To reach 5–6 million tourists, Azerbaijan would need to more than double its current annual inflow while simultaneously increasing spending per visitor. This requires shifting from event-driven visibility to experience-based, regionally distributed tourism.

Niche segments, health tourism, wine tourism, eco-tourism, and gastronomy, offer quantitative potential. Health tourists, for instance, typically stay 12–28 days, spend significantly more per capita, and travel year-round. Yet Azerbaijan has not integrated these advantages into a coherent national tourism product.

The new State Program acknowledges many of these shortcomings and sets clear numeric ambitions. However, the data suggests that success will depend on implementation rather than strategy design. Without tangible improvements in accessibility, pricing transparency, digital marketing, and regional service quality, Azerbaijan risks repeating the pattern of previous initiatives, strong on vision, weak on measurable outcomes.

If execution matches ambition, the 5–6 million target is achievable. If not, Azerbaijan’s tourism sector may continue to grow slowly, remaining below its regional and economic potential.

Here we are to serve you with news right now. It does not cost much, but worth your attention.

Choose to support open, independent, quality journalism and subscribe on a monthly basis.

By subscribing to our online newspaper, you can have full digital access to all news, analysis, and much more.

You can also follow AzerNEWS on Twitter @AzerNewsAz or Facebook @AzerNewsNewspaper

Thank you!