Skepticism jumps in options as VIX 4-day gain is most since 2011

By Bloomberg

Options traders aren’t buying the stock market’s message.

While the Standard & Poor’s 500 Index posted its first gain of the week on Dec. 11, rising 0.5 percent, the Chicago Board Options Exchange Volatility Index also jumped, climbing 8.4 percent to cap its biggest four-day advance since 2011. The two gauges, one measuring share prices and the other anxiety among traders, only move in unison about 20 percent of the time.

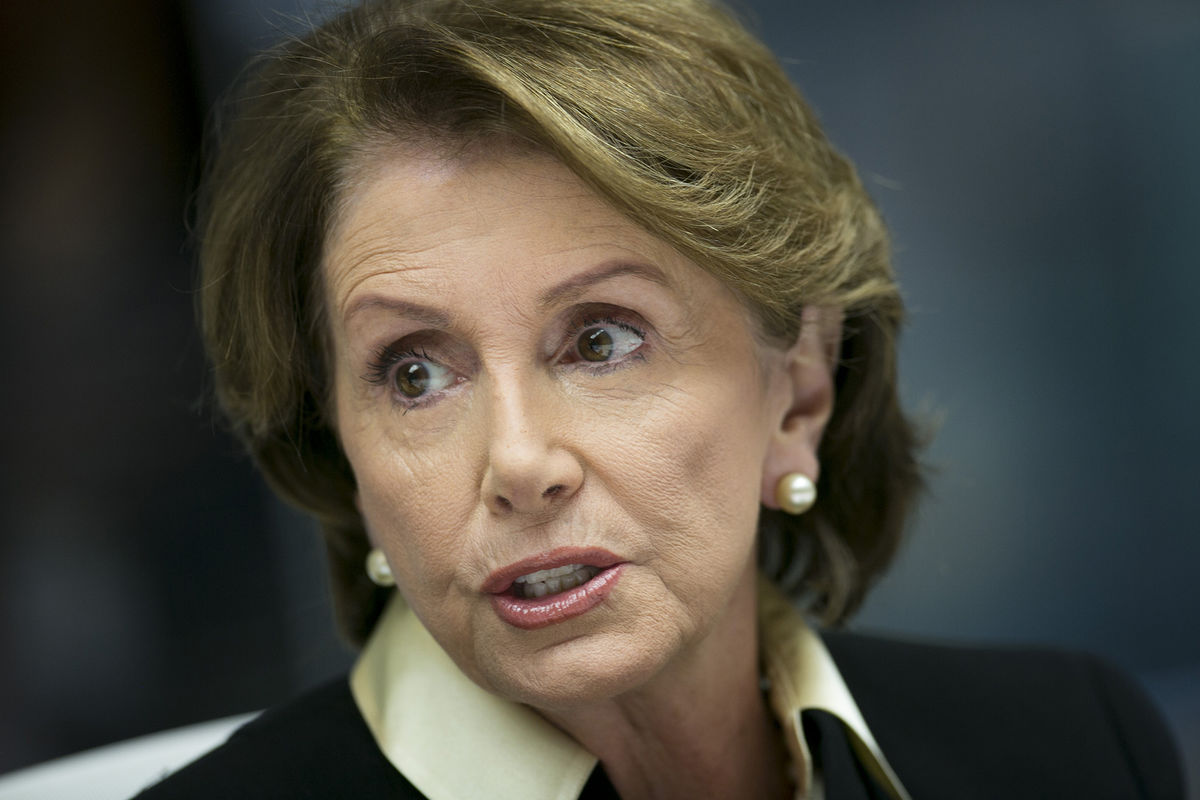

Investors watching oil plunge day after day are growing concerned the decline will destabilize financial markets and that’s boosting demand for hedges, according to Bob Doll, the chief equity strategist at Nuveen Asset Management. Gains in the VIX picked up after House Minority Leader Nancy Pelosi said Republicans lack the votes to pass a $1.1 trillion U.S. spending bill and urged fellow Democrats to force removal of some banking and campaign-finance provisions.

“I’d put oil front and center,” Doll said by phone. “We’ve had a move from $100 to $60, and if that had happened over a year or two that’s one thing, but this has been so much so fast that it creates higher uncertainty, which creates higher volatility, and that’s the reason you’re seeing people buy protection.”

The S&P 500 and VIX haven’t posted a bigger lockstep advance since at least 2000, according to data compiled by Bloomberg. They’ve both gained on the same day on only 22 other times this year, the data show.

Oil Selloff

U.S. stocks rebounded from the worst day in eight weeks as an improvement in retail sales helped overshadow a drop in West Texas Intermediate crude below $60. The S&P 500 rose 0.5 percent yesterday, paring an earlier rally of 1.5 percent. WTI dropped another 0.9 percent at 7:12 a.m. in New York today.

“It is unusual to see stocks rally like they did and premiums rise on the same day,” Jared Woodard, a New York-based equity derivatives strategist at BGC Partners LP, said by phone. “When the index gave back a lot of these gains you saw more demand for put protection. As stocks reversed a bit, people thought there may be another leg down.”

Signs abound that investors want to lock in equity gains or protect against sudden losses.

Implied volatility of one-month options contracts on the S&P 500 since Monday climbed 3.8 points relative to the price of six-month contracts, data compiled by Bloomberg show. That’s the fastest four-day jump in the shorter-term contracts since September 2011, a sign to Woodard that investors are becoming more wary of risk.

‘Less Tolerant’

“It tells you investors are becoming less tolerant to relatively routine market dips,” Woodard said. “When options with one- or two-month maturity become more expensive quickly, that’s a signal investors are legitimately concerned about risk.”

The starkest message is being sent by the VIX itself, as the volatility gauge is known. After falling to a three-month low at the end of last week, the fear gauge has twice surged more than 20 percent this week and is above 20 for the first time since global markets buckled in mid-October.

“How could you be sold on the price action today?” Rick Fier, director of equity trading at Conifer Securities LLC in New York, said in a phone interview. “People see crude breaking down while the market is up and decide to get some protection because a lot of selling has already been done. It’s an easy trade. There are a lot of problems out there.”