Moscow risks losing its most reliable partner in South

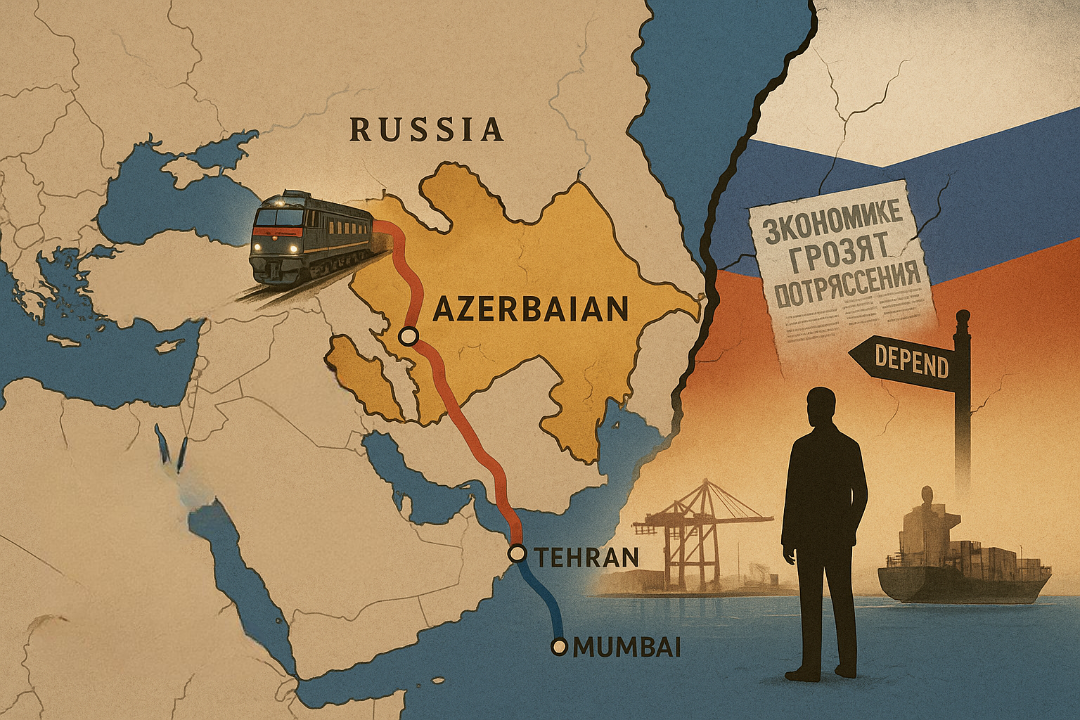

Although recent signs suggest a mild easing of tensions between Baku and Moscow, bilateral relations remain fragile. These frictions inevitably bring into question the future of major joint economic and logistical projects, especially the strategic North-South Transport Corridor and a critical Russian gas delivery plan to Iran via Azerbaijani territory. Both initiatives hinge directly on Azerbaijan’s stance, making Baku an indispensable player in shaping the region’s energy and transport future.

At the same time, the Russian media has intensified coverage of the possible economic fallout of a complete breakdown in bilateral ties. A recurring narrative suggests Azerbaijan’s greater vulnerability, emphasising its export dependence on Russia and quoting select trade statistics to back the claim.

According to 2024 trade data, Azerbaijan’s top non-energy exports included plastics and plastic products ($368.9 million), gold ($211.9 million), cotton ($177.1 million), exotic fruits ($175.5 million), tomatoes ($175.4 million), passenger cars ($171.7 million), nuts ($131.3 million), fertilizers ($126.2 million), aluminum sheets ($110.1 million), and stone fruits ($99.4 million). Russia is the main importer for at least half of these categories. Specifically, Russia accounted for:

-

98% of Azerbaijan’s stone fruit exports ($97.1 million)

-

96% of tomato exports ($168.7 million)

-

87% of exotic fruits ($153.4 million)

-

64% of plastic products ($235.7 million)

-

53% of nuts ($70.2 million)

From the import side, Russian experts argue that Azerbaijan’s domestic oil market is supported by imports of Russian Ural oil (1.53 million tons in 2024), which Azerbaijan purchases for domestic use while exporting its premium Azeri Light crude. According to UN Comtrade data, nearly $1.18 billion of Russian exports to Azerbaijan in 2024 were in the energy category, making up one-third of total exports.

In the first four months of 2025, the structure of Russian exports to Azerbaijan shifted slightly:

-

Precious stones and metals led with $439.4 million, or 29%

-

Mineral fuels followed with $355.3 million, or 24%

-

Ferrous metals ranked third with $103.8 million, or 7%

Russia undeniably represents one of Azerbaijan’s largest export markets, especially for agricultural products. In 2024, Azerbaijan exported approximately $1 billion worth of goods to Russia, with two-thirds consisting of agricultural products such as fruits, vegetables, and canned goods.

However, the dependence is not one-sided. Russia’s exports to Azerbaijan in 2024 totaled $3.6 billion—more than 3.5 times Azerbaijan’s exports to Russia. In the first five months of 2025, Azerbaijan exported $445 million in goods to Russia, while importing $1.7 billion—again reflecting a 3–4x trade imbalance.

For Moscow, losing Azerbaijan as a market—especially in the southern regions—would cause serious setbacks, given Azerbaijan’s reliability and low logistical costs. Furthermore, Russia would lose a key transit partner for Caspian trade and for the Western route of the North–South Transport Corridor, which remains the most cost- and time-efficient connection to Iran and India

Tomatoes, a highly visible export item, illustrate both dependence and opportunity. In the first five months of 2025, Azerbaijan exported 98,500 tons of tomatoes worth $113 million, mostly to Russia, averaging $1.15 per kilogram.

Azerbaijan supplies tomatoes to Russia because the country still relies on imports from it. The share of tomato imports from Azerbaijan to the Russian market is 30-35 percent. Due to the worsening relations between the countries, there are currently no issues with the supply of this vegetable. The purchase of oil and fuel from Russia is mentioned in some articles as a factor that could put Azerbaijan in a vulnerable position, but in reality, these purchases started in 2023 after the ban on the supply of Russian oil and oil products to Europe. These steps by Azerbaijan are a form of support for Moscow, which has not found a market for its products. If they had not purchased these products until 2023, wouldn't Azerbaijan have been able to provide itself with them? As for Azerbaijan's exports to Russia, the figure is nearly four times less than the imports from Russia.

During its suspension, diversification of exports for certain products can be achieved quickly. Specifically, it’s possible to expand the export geography concerning plastic products and agro-industrial products in a short time. Regarding purely agricultural products, which were valued at $600 million last year, even if no new markets are found for any of them, Azerbaijan's loss will be much less than Russia's. Last year, goods and products worth $3.6 billion were sold from Russia to Azerbaijan. In the first four months of this year, this amount was $1.5 billion. Losing such a large market would be a significant loss for Russia, which is being pushed out of developed countries’ markets.

Concerning Azerbaijan's reliance on the Russian market in agriculture, it’s clear that being almost 80% dependent on Russia for agricultural exports is not a very positive situation, especially considering the current state of relations. Still, it’s necessary to find access to more premium markets. In the first five months of 2025, Azerbaijan sold $445 million worth of goods to Russia and bought $1.7 billion worth from Russia. That means Russia already sells 3 to 4 times more to us than we sell to them. They are losing more in trade, though they might not realise it. However, we need to find ways to enter new markets and, most importantly, increase exports to Gulf countries and Central Asian republics. The same applies to tomatoes — in the first five months of this year, we sold 98.5 thousand tons of tomatoes worth $113 million, meaning the export value to Russia is roughly $1.15 per kilogram. As far as we know, there are no tomatoes of the same quality as Azerbaijani ones in Gulf countries, and the average price point could be higher, potentially. While Gulf countries are making strides in tomato production to meet local demands, they still rely on imports to fully satisfy their needs, particularly during peak consumption periods.

Moreover, transit dynamics favour Azerbaijan in the long term. Over 70% of the cargo handled at the Baku Port in 2024—5.3 million tons—was transit cargo, showcasing Azerbaijan’s rising importance in Eurasian logistics.

Russia’s economic reliance on Azerbaijan deepens when it comes to the North–South Corridor. With Europe closing its ports to Russian ships, Moscow needs reliable access to India, its largest oil buyer in 2024. The western branch of the corridor—passing through Azerbaijan—is more efficient than the eastern (Kazakhstan–Turkmenistan) and central (via the Caspian Sea) alternatives.

To secure this route, Russia agreed in May 2023 to finance the construction of the Rasht–Astara railway in Iran, investing €1.3 billion of a €1.6 billion project as an intergovernmental loan. Construction began in May 2025 despite Iranian setbacks, including Israeli airstrikes in Rasht and intensified U.S. sanctions. The project includes:

-

162 km of new railway

-

8 stations, 56 road junctions, 73 bridges, and 30 overpasses

-

Expected capacity of 15 million tons of cargo per year, connecting Ust-Luga to Bandar Abbas

If tensions with Baku escalate further, Russia risks losing this critical route, forcing a shift to costlier and slower alternatives.

Unlike Russia, Azerbaijan has consistently honoured its obligations in bilateral and regional cooperation. But if Moscow continues down a hostile path, Baku may be left with no choice but to reassess its economic and logistical commitments. We hope such a situation does not arise; if it does, the costs for Russia, already struggling with sanctions and losing ground in Western markets, could be significant.

Here we are to serve you with news right now. It does not cost much, but worth your attention.

Choose to support open, independent, quality journalism and subscribe on a monthly basis.

By subscribing to our online newspaper, you can have full digital access to all news, analysis, and much more.

You can also follow AzerNEWS on Twitter @AzerNewsAz or Facebook @AzerNewsNewspaper

Thank you!