The responsible investor’s guide to climate change

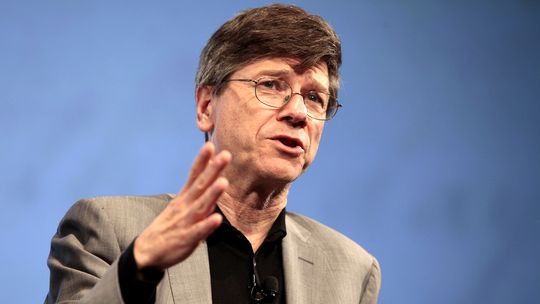

By Jeffrey Sachs

Director of the Earth Institute at Columbia University. Lisa Sachs is Director of the Columbia Center on Sustainable Investment.

Around the world, institutional investors – including pension funds, insurance companies, philanthropic endowments, and universities – are grappling with the question of whether to divest from oil, gas, and coal companies. The reason, of course, is climate change: unless fossil-fuel consumption is cut sharply – and phased out entirely by around 2070, in favor of zero-carbon energy such as solar power – the world will suffer unacceptable risks from human-induced global warming. How should responsible investors behave in the face of these unprecedented risks?

Divestment is indeed one answer, for several reasons. One is simple self-interest: the fossil-fuel industry will be a bad investment in a world that is shifting decisively to renewables. (Though there will be exceptions; for example, fossil-fuel development in the poorest countries will continue even after cutbacks are demanded in the rich countries, in order to advance poverty reduction.)

Moreover, divestment would help accelerate that shift, by starving the industry of investment capital – or at least raising the cost of capital to firms that are carrying out irresponsible oil, gas, and coal exploration and development, despite the urgent need to cut back. Though no single institutional investor can make a significant difference, hundreds of large investors holding trillions of dollars of assets certainly can.

Indeed, divestment by leading investors sends a powerful message to the world that climate change is far too dangerous to accept further delays in the transition to a low-carbon future. Divestment is not the only way to send such a message, but it is a potentially powerful one.

Finally, investors may divest for moral reasons. Many investors do not want to be associated with an industry responsible for potential global calamity, and especially with companies that throw their money and influence against meaningful action to combat climate change. For similar reasons, many investors do not want handgun manufacturers or tobacco companies in their portfolios.

Yet there is also an ethically responsible and practical alternative to divestment that can help steer fossil-fuel companies toward the low-carbon future. As active, engaged shareholders, institutional investors can use their ownership (and, in the case of large investors, their public voice) to help persuade companies to adopt climate-safe policies.

American universities are on the front line of this debate, pushed by their students, who are young enough to face the brunt of climate change in the coming decades. The students are right to be frustrated that most university endowments have so far been passive on the issue, neither divesting nor engaging as active investors. For example, Harvard University President Drew Gilpin Faust sharply rejected divestment in 2013; the purpose of Harvard’s endowment, she argued, is to finance the university’s academic activities. Though she did say that Harvard would be an active and responsible shareholder, she offered no details about what such engagement might look like.

Harvard and many other universities (including our own, Columbia University) have long been committed to acting as responsible investors. Several have committees that advise university trustees on environmental, social, and governance (ESG) issues in their portfolio, most commonly when proxy votes in support of ESG proposals are to be held. Yet few so far have applied the ESG principles to their endowment’s fossil-fuel holdings.

Despite Faust’s rejection of divestment, Harvard and other universities have long accepted the principle that divestment is the correct choice in certain circumstances. In 1990, Harvard divested completely from tobacco companies. Harvard’s president at the time, Derek Bok, said that the university’s decision “was motivated by a desire not to be associated as a shareholder with companies engaged in significant sales of products that create a substantial and unjustified risk of harm to other human beings.” Many other universities, including Columbia, have done the same.

Today’s students make cogent arguments that the case for fossil-fuel divestment looks similar to the case for tobacco divestment. Both represent massive risks to human wellbeing.

Before divesting from tobacco companies, Harvard wrote to them, requesting that they address the ethical issues involved in selling tobacco and their adherence to World Health Organization guidelines. The companies either were unresponsive or challenged the evidence that smoking was linked to disease.

Similarly, in deciding whether to divest, responsible investors like universities should ask four key questions of the oil, gas, and coal companies in their portfolio:

• Has the company publicly and clearly subscribed to the internationally agreed goal of limiting global warming to 2º Celsius above pre-industrial levels, and to the limits on global carbon-dioxide emissions needed to meet that goal?

• Will the company pledge to leave business groups that lobby against effective climate policies to achieve the 2º limit?

• Will the company agree to end any exploration and development of unconventional reserves (for example, in the Arctic and much of the Canadian oil sands) that science has shown to be inconsistent with the 2º limit?

• Can the company demonstrate that it remains a good investment, despite the transition to low-carbon energy sources and technologies (for example, by demonstrating its own plans to make such a transition or highlighting its contributions to poverty reduction)?

If companies can give convincing answers to these four questions, they may indeed remain part of the portfolio, and responsible investors can work with them as part of the climate solution, rather than concluding that they are part of the problem and parting ways. For those companies that duck the questions, including by claiming that the world will not in fact enforce the 2º limit, divestment would make sense on both financial and ethical grounds, as such companies are clearly not prepared to contribute to creating a low-carbon economy.

Of course, the need for climate action does not stop with investors; sustainable consumption and production practices by businesses and individuals must be part of the solution as well. The transition to a safe, low-carbon future requires all parts of society to act responsibly and with foresight. As leaders in education, research, and problem solving, universities have a unique responsibility and opportunity to lead, including as responsible and ethical investors.

---

Follow us on Twitter @AzerNewsAz

Here we are to serve you with news right now. It does not cost much, but worth your attention.

Choose to support open, independent, quality journalism and subscribe on a monthly basis.

By subscribing to our online newspaper, you can have full digital access to all news, analysis, and much more.

You can also follow AzerNEWS on Twitter @AzerNewsAz or Facebook @AzerNewsNewspaper

Thank you!