Vodafone paid too little for Kabel Deutschland, auditor says

By Bloomberg

Vodafone Group Plc’s $11 billion takeover of Kabel Deutschland Holding AG undervalued the German cable provider, an independent review proposed by activist shareholder Elliott Management Corp. showed.

Investment banks’ financial projections suggest Kabel Deutschland should have been worth 104 euros ($128) a share, according to the Sept. 29 report by Frankfurt-based auditor Constantin GmbH that was released to investors this week. Cost savings and extra revenue after the acquisition could add about 23.50 euros to that value, Constantin said. Kabel Deutschland investors received 87 euros for each share including a dividend.

The findings may bolster Elliott’s case as the New York- based hedge-fund manager, which has held on to its Kabel Deutschland shares, wants Vodafone to pay more. Elliott is suing Kabel Deutschland in a German court, saying Vodafone should have paid more than 250 euros a share. The audit, commissioned at Kabel Deutschland’s shareholder meeting in October 2013, took a year to complete as Constantin sifted through non-public communications among company executives.

“The special auditor picks only the highest value from a wide range of valuations and ignores lower, more reasonable expectations,” Vodafone said in an e-mailed response.

Elliott’s claims are unfounded and “can’t be taken seriously,” said Alexander Leinhos, a Vodafone spokesman in Germany. Kabel Deutschland’s valuation was based on an assessment confirmed by a court-appointed independent auditor and Vodafone doesn’t plan to increase its offer to the remaining Kabel Deutschland shareholders, he said.

Vodafone shares fell 1.3 percent to 227.05 pence at 8:05 a.m. in London trading.

Internal Projections

At the top-end valuation, Kabel Deutschland shares may be worth 150.50 euros including synergies, according the report.

Constantin said there are “indications of a possible breach of duty” by Kabel Deutschland’s executive board as it didn’t make documents available beyond March 31, 2013. The board also didn’t inform financial analysts of its more positive assessment of the carrier’s future growth, according to the report.

Internal planning by Kabel Deutschland showed that revenue would more than double from 1.84 billion euros between 2013 and 2021, the report showed. Earnings before interest, taxes, depreciation and amortization were forecast to more than double from 860 million euros over the same period, the auditor said.

The report also said Kabel Deutschland ended talks in January 2013 over selling access to its network to Telefonica Deutschland Holding AG. Terminating the talks meant Kabel Deutschland investors missed out on an estimated cash value of about 160 million euros from a deal, the auditor said.

Marco Gassen, a spokesman for Kabel Deutschland in Munich, didn’t respond to calls seeking comment.

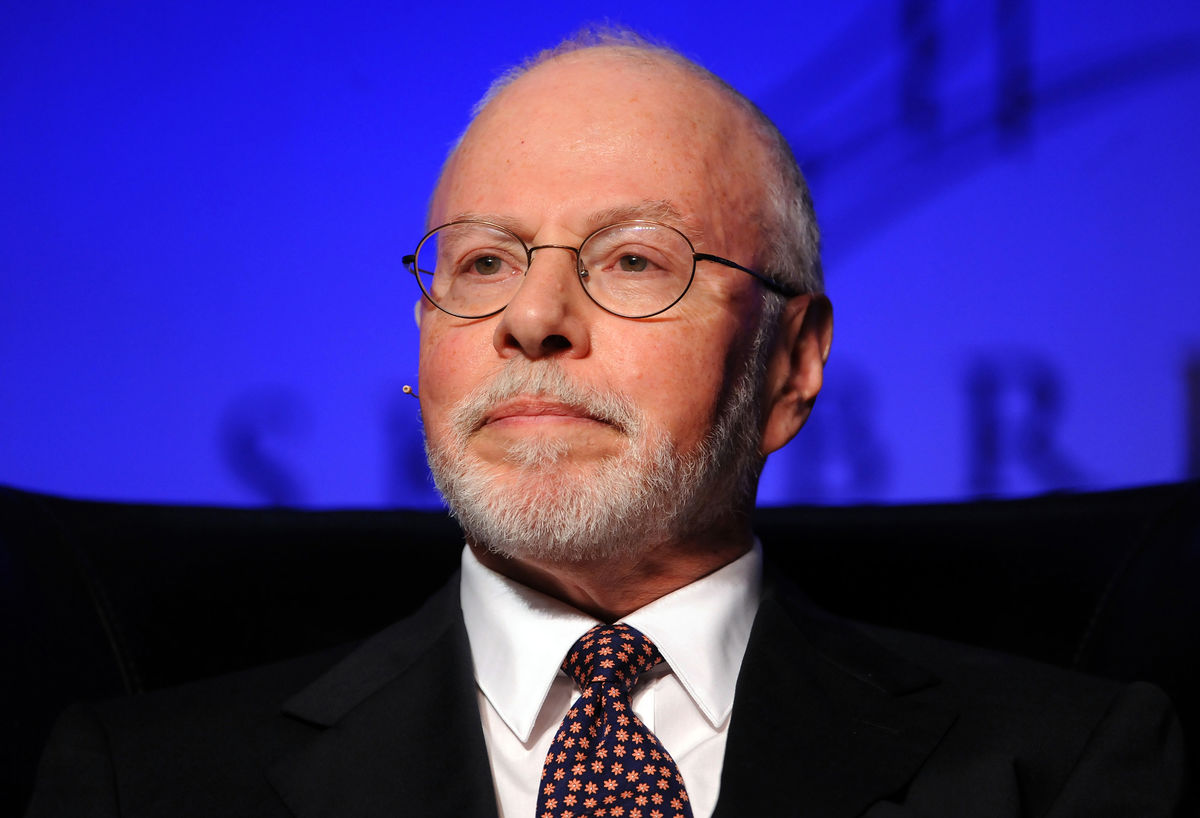

Elliott, which is run by billionaire Paul Singer, manages two hedge funds that combined have more than $24 billion of assets under management. It began investing in Kabel Deutschland after Vodafone agreed to buy the company in July last year. Elliott funds owned about 13 percent of Kabel Deutschland as of April, data compiled by Bloomberg showed.

In October, Elliott called on EMC Corp. to spin off its software company VMware Inc. It also nominated a suite of directors to Family Dollar Stores Inc.’s board in an attempt to push the company to sell to rival Dollar General Corp. and sought contempt orders against Argentina in a bond dispute.

Here we are to serve you with news right now. It does not cost much, but worth your attention.

Choose to support open, independent, quality journalism and subscribe on a monthly basis.

By subscribing to our online newspaper, you can have full digital access to all news, analysis, and much more.

You can also follow AzerNEWS on Twitter @AzerNewsAz or Facebook @AzerNewsNewspaper

Thank you!