Former Banker assesses inflation in Turkiye

On Thursday, TURKSTAT (TUIK) released the annual consumer price and noted that annual inflation climbed to 61.53 percent and the month-on-month inflation rate amounted to 4.75 percent. It is worth noting that the figure is under the expectations. In a Reuters poll, annual inflation was expected to rise to 61.7 percent.

To recall that Turkiye has suffered from high inflation for two years, and previously many related the high inflation rate to Turkish President Recep Tayyip Erdogan's economic visions. However, after the presidential elections in May 2023, Turkiye returned to orthodox economic policies. Contrary to previous predictions, the inflation rate remains high.

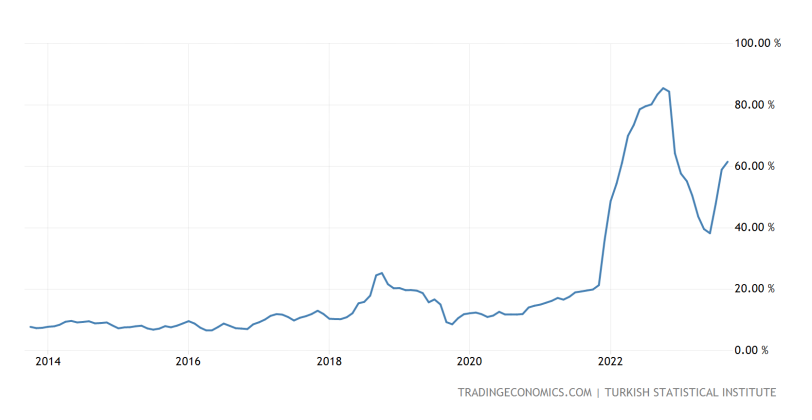

Speaking to Azernews on the issue Ünsal Sözbir, the MUSIAD board member and former banker, noted that inflation in Turkiye, which has been in the 10-20 percent range for a long time, has exceeded 80 percent in 2022 and is above 60 percent according to current data. There are differences between inflation rates given by TURKSTAT and other independent organizations and the differences relate to the methods and baskets. He pointed out that in any case, everyone accepts that inflation in Turkiye is very high and needs to be reduced urgently. However, he added that it has a background and it should be underlined.

"As the table demonstrates, a movement has started in prices since the second half of 2018, and the inflationary pressure experienced in the world with the COVID-19 process has been felt much more severely in Turkiye. We can say that the main reason for this is that Turkiye has prioritized growth in macroeconomic policies. Namely, one of the most important visions of President Recep Tayyip Erdoğan is a Turkiye that constantly produces, invests to produce, and can export its manufactured products to the world. In order for this to happen, the argument that the cost of financing to provide the investment should be low has been permeated to all policies," Ünsal Sözbir noted.

He told that since the supply chain disrupted by COVID-19 created inflationary pressure in the world, it was thought that this was temporary and would normalize over time in Turkiye, as in the major economies of the world. In order to make the COVID process easier, many countries, especially the USA, have resorted to non-monetary expansion. In order to prevent the contraction of the economy in Turkiye, the credit facilities of the banking system were expanded and borrowing opportunities were provided to large segments of society, especially individuals.

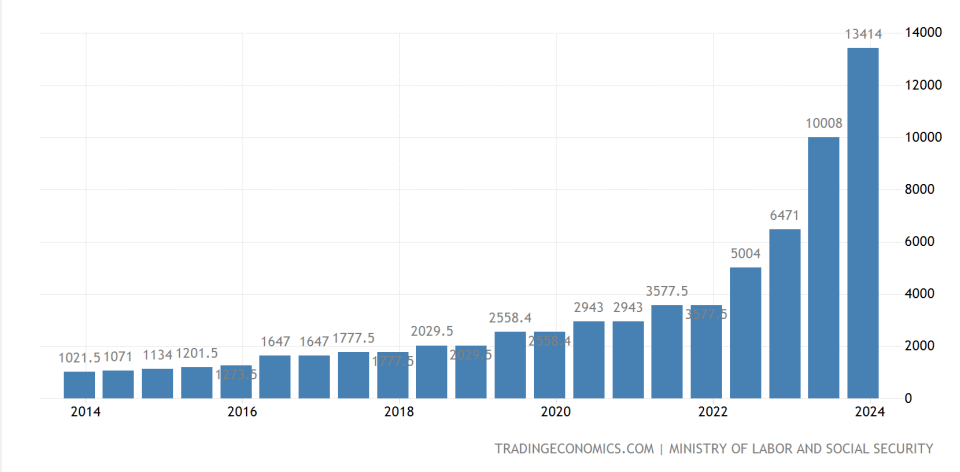

"It is a known fact that low-cost financing opportunities lead people and businesses to buy goods in environments with rising prices. In Turkiye, while people were buying cars and houses, businesses also tended to increase their stocks, which caused a demand-based price increase. Supply chain-based price increases around the world have also triggered cost inflation upwards. Increases in pensions and the minimum wage, to protect low-income earners against increasing inflation have caused all wages to rise. As can be seen from the table below, which shows the course of the minimum wage, the minimum wage in Turkiye has increased approximately 4 times in 2 years," the Former Banker said.

Ünsal Sözbir noted that after the increases in all wages, the increasing costs were reflected in every field, and inflation based on expectations was added to inflation based on demand and cost. He emphasized that a significant part of the high inflation that Turkiye is currently experiencing stems from these expectations.

"Behaviorally, the expectation that prices will increase causes people and businesses to add costs they have not yet incurred to the products they sell. It is possible to say that although the high inflation experienced in Turkiye is primarily due to demand and finance, it is mostly expectation inflation. Of course, the depreciation in the Turkish Lira also has a very significant impact on this process," he pointed out.

As for the impacts of inflation, he said that the most important impacts of inflation in all economies are the reduction in people's spending power and the deterioration of justice in income distribution. The impacts of this are clearly seen in Turkiye as well, and the Government is trying to take precautions on these issues.

"However, this turns into a spiral as the measures taken also trigger inflation expectations. When evaluating the Turkish economy, it is necessary to take into account the impact of the earthquakes that hit Kahraman Maraş, which is called the Disaster of the Century. It is worth noting that the Disaster of the Century increased the need for resources and reached at least 100 billion dollars," he noted.

He also touched on the fighting against inflation and underlined that Turkiye has made a serious policy change as of June 2023 to fight inflation and has put into effect monetary and fiscal policies that have not been used for a long time, along with the changing economic management. The Former Banker added that in the 2023-2025 Medium Term Program (MTP), which was prepared by taking into account the importance given by President Erdoğan to the growth of the economy, very important issues concerning the macroeconomy were pointed out and a concrete calendar was determined for the steps to be taken.

"With the policy rate increases that were initiated before the MTP and continued after, on the one hand, it is aimed at breaking the demand that causes inflation, and on the other hand, very intensive efforts are being made to reach the external financial resources that the country needs. While individuals are prevented from accessing financial resources, on the other hand, the search for and supply of resources that will support the investment and exports needed by businesses continues. Turkiye is determined to fight inflation, which reduces purchasing power and impoverishes people. Focusing on this issue with all its institutions, it gives its trust and support to the staff managing the economy. As stated in the prepared MTP, this process is quite difficult. Awareness has largely been formed that single-digit inflation will only be reached in 2026 and that not only the Government but also the whole of Turkiye must support this. All stakeholders are aware that additional work is needed to reduce the negative effects of this struggle on businesses and people," Ünsal Sözbir concluded.

---

Qabil Ashirov is AzerNews’ staff journalist, follow him on Twitter: @g_Ashirov

Follow us on Twitter @AzerNewsAz

Here we are to serve you with news right now. It does not cost much, but worth your attention.

Choose to support open, independent, quality journalism and subscribe on a monthly basis.

By subscribing to our online newspaper, you can have full digital access to all news, analysis, and much more.

You can also follow AzerNEWS on Twitter @AzerNewsAz or Facebook @AzerNewsNewspaper

Thank you!